25. Tax credit for children's activities (Line 462)

You can claim a refundable tax credit for the physical activities or artistic, cultural or recreational activities of an eligible child, provided you meet all of the following conditions:

- You were resident in Québec on December 31, 2023.

- In 2023, you or your spouse on December 31, 2023, paid to either:

- register the child in a program that is not part of a school's curriculum and that includes physical activities or artistic, cultural or recreational activities for children that take place over at least eight consecutive weeks or at least five consecutive days (in the case of a summer camp, for example); or

- obtain a membership for the child in a club, association or similar organization that offers physical activities or artistic, cultural or recreational activities for children, provided that the membership is for a minimum period of eight consecutive weeks.

- Your family income does not exceed $155,880 (your family income is the amount on line 275 of your return plus, if applicable, the amount on line 275 of the return of your spouse on December 31, 2023).

- You have a receipt that constitutes proof of payment of eligible registration or membership fees. You must keep your receipt in case we ask for it.

- In the case of a program that lasts at least five consecutive days, more than 50% of its daily activities must include a significant amount of physical activity or artistic, cultural or recreational activities.

- In the case of a weekly program that lasts at least eight consecutive weeks, all or almost all the activities must include a significant amount of physical activity or artistic, cultural or recreational activities.

- A program of extracurricular activities offered by a school is not considered to be part of the school's curriculum.

- The activities must be supervised.

You or your spouse was not resident in Canada throughout the year

If, for all or part of 2023, you or your spouse was not resident in Canada, you must take into account, in calculating your family income, all the income you and your spouse earned, including any income earned while you or your spouse was not resident in Canada.

Eligible child

To be eligible, a child must have been born after December 31, 2006, but before January 1, 2018. If the child has a severe and prolonged impairment in mental or physical functions (see the instructions for line 376), they must have been born after December 31, 2004, but before January 1, 2018.

An eligible child can be:

- your or your spouse's child;

- a person of whom you or your spouse has the custody and supervision (legally or in fact).

Calculating the tax credit

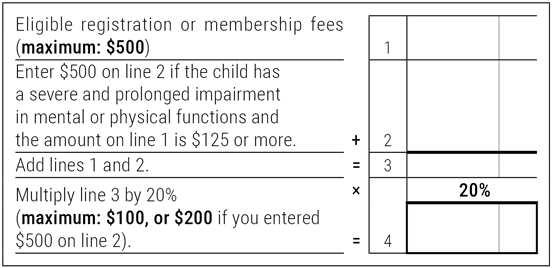

The tax credit is equal to 20% of the eligible registration or membership fees. You can claim a maximum of $500 in fees per child, for a maximum tax credit of $100 per child. If the child has a severe and prolonged impairment in mental or physical functions and the eligible fees are $125 or more, you can add $500 to the amount of the fees. However, the total ($500 plus the amount of the eligible fees) cannot exceed $1,000 per child, for a maximum tax credit of $200 per child.

Use the work chart below to calculate the amount of the tax credit to which you are entitled. Calculate a separate amount for each eligible child and then add up the amounts for all the eligible children. Carry the total to line 462 of your income tax return.

Work chart – Tax credit for children's activities for each eligible child

- Enter the eligible registration or membership fees (maximum $500). If the child has a severe and prolonged impairment in mental or physical functions and the eligible registration or membership fees are at least $125, you can add $500 to the amount. Multiply the result by 20%.

- The result is the amount of your tax credit.

Splitting the tax credit

If another person is also entitled to this tax credit for the same eligible child, you can split the credit. While you can choose how you split it, the total amount claimed by both of you cannot exceed the amount to which you would have been entitled if only one of you were claiming the credit.

Fees that are not eligible

You cannot claim the tax credit for any of the following:

- fees paid for a program of activities offered by a person who, at the time of payment, was either your spouse or under 18 years of age;

- fees for which anyone (you, your spouse or another person) received, or is entitled to receive, a reimbursement, unless the reimbursement was included in that person's income and cannot be deducted elsewhere in that person's income tax return;

- fees that were used to calculate another deduction or refundable or non-refundable tax credit claimed by you, your spouse or another person;

- fees paid for a sports-study (Sport-Études) program or an arts-study (Art-Études) program.