1. Introduction

This guide must be used for 2025. It will help you complete the RL-1 summary (form RLZ-1.S-V, Summary of Source Deductions and Employer Contributions).

The guide does not take into account legislative amendments announced after October 31, 2025, and the information in it does not constitute a legal interpretation of the Taxation Act or any other legislation. You must therefore make sure that the information reflects current fiscal legislation.

For more information, contact us.

1.1. Explanation of references

The references below certain paragraphs are to sections of different laws, regulations and interpretation bulletins. References to the Taxation Act consist of a number only. References to the Regulation respecting the Taxation Act consist of the letter “R” preceded and followed by numbers. All other letter-number references are to one of the laws or regulations, or to an interpretation bulletin listed in this section.

Laws

ALS: Act respecting labour standards

ARAMQ: Act respecting the Régie de l'assurance maladie du Québec

AWSDR: Act to promote workforce skills development and recognition

TAA: Tax Administration Act

Interpretation bulletins

RAMQ: Revenu Québec interpretation bulletin concerning the Act respecting the Régie de l'assurance maladie du Québec

Regulations

ALS (r. 5): Regulation respecting contribution rates

API (r. 3): Regulation respecting parental insurance plan premiums

AQPP (r. 2): Regulation respecting contributions to the Québec Pension Plan

ARAMQ (r. 1): Regulation respecting contributions to the Québec Health Insurance Plan

AWSDR (r. 3): Regulation respecting eligible training expenditures

AWSDR (r. 4): Regulation respecting the determination of total payroll

AWSDR (r. 5): Regulation respecting the exemption applicable to a holder of a training initiative quality certificate

AWSDR (r. 7): Regulation respecting training mutuals

TAA (r.1): Regulation respecting fiscal administration

2. Main change

As of 2025, a single contribution rate applies to all employers subject to the contribution related to labour standards. See the section Contribution related to labour standards.

3. General information

3.1. Is this guide for you?

Use this guide if you are an employer or a payer and you have to file the RL-1 summary (form RLZ-1.S-V, Summary of Source Deductions and Employer Contributions).

The guide provides:

- instructions and explanations regarding the amounts you have to enter on the RL-1 summary to calculate source deductions and employer contributions for the year (see How to complete the RL-1 summary)

- information on the payment methods available if you have a balance due (see Making your payment)

For information on filing the RL-1 slip, see the Guide to Filing the RL-1 Slip (RL-1.G-V). For information on calculating and making periodic remittances of source deductions and employer contributions, see the Guide for Employers (TP-1015.G-V).

3.2. Purpose of the RL-1 summary

You use the RL-1 summary to compare the source deductions of income tax, Québec Pension Plan (QPP) contributions, Québec parental insurance plan (QPIP) premiums and the contribution to the health services fund with the duties you reported for the year. You also use the RL-1 summary to calculate the contribution to the health services fund, the contribution related to labour standards, the contribution to the Workforce Skills Development and Recognition Fund (WSDRF) and the total of eligible training expenditures that may be carried forward (where applicable).

When we receive your RL-1 slips and RL-1 summary, we carry out a cursory review. If we notice that, for example, you did not calculate sufficient contributions, we may send you a notice of assessment detailing any revised amount, or we may send you one of the following forms for you to complete:

- Statement of Employee and Employer QPP Contributions (LMU-141-V or LMU-141.1-V)

- Statement of Québec Parental Insurance Plan Premiums (LMU-150-V)

- Statement of Employer Contributions (LMU-142-V)

3.3. Are you required to file the RL-1 summary?

You are required to file the RL-1 summary if any of the following applies:

- You have to file an RL-1 slip.

- You have to file an RL-2, an RL-25 or an RL-32 slip to report amounts on which you withheld Québec income tax.

- You withheld Québec income tax, Québec Pension Plan (QPP) contributions or Québec parental insurance plan (QPIP) premiums.

- You are required to pay the employer QPP contribution, QPIP premium or contribution to the health services fund.

- You are required to pay the contribution related to labour standards.

- You are required to participate in workforce skills development and have to inform us of your total payroll and eligible training expenditures.

- You are required to pay the employer contribution to the Workforce Skills and Development Recognition Fund (WSDRF).

Even if you were not required to file the RL-1 summary for the year, your account may have remained open. If you expect your situation to be the same in the coming year, you must inform us.

References: 1086R1; ARAMQ (r.1) 3; AWSDR 16; ALS 39.0.4; AQPP (r. 2) 11; API (r.3) 7

3.3.1. You have more than one account number

If you have more than one employer account, you must file an RL-1 summary for each account, under the name and identification number shown on the Remittance of Source Deductions and Employer Contributions (form TPZ-1015.R.14.1-V, TPZ-1015.R.14.2-V, TPZ-1015.R.14.3-V or TPZ-1015.R.14.4-V, according to your remittance frequency) for each one.

3.3.2. Employer that succeeds another employer

If an employer succeeds another employer following the formation or winding-up of a corporation or following the acquisition of the major portion of the property of a business or of a separate part of a business, and there was no interruption in an employee's service, the successor employer and the previous employer must each file the RL-1 summary for the period that concerns them.

If an employer that is a corporation amalgamates with one or more other corporations, the corporation resulting from the amalgamation must file the RL-1 summary for the entire year.

If an employer that is a parent corporation winds up a subsidiary and at least 90% of the subsidiary's property is attributed to the parent corporation, the parent corporation must file the RL-1 summary for the entire year.

See Special cases for information on filing the RL-1 summary in situations in which an employer succeeds another employer.

4. Filing the RL-1 summary

4.1. Filing methods

You must file the RL-1 summary in the prescribed form.

To file, you can use any of the following:

- the paper form (either the form we mail to you each year or the form you order from us online or by contacting us)

- the online services in My Account for businesses

- the PDF summary (RLZ-1.S-V) that can be completed onscreen

- software you purchased or developed

Specialized service providers, such as an accountant or a payroll service, can file your RL-1 summary using the online services in My Account for professional representatives.

4.2. Filing deadline

The deadline for filing the RL-1 summary with us is the last day of February of the year following the year covered by the summary.

If you have stopped making periodic remittances of source deductions and employer contributions or have stopped operating your business, or if the person required to file the RL-1 summary with us has died, see Table 1 below for the RL-1 summary filing deadline.

The deadline for filing the RL-1, RL-2, RL-25 and RL-32 slips for the year is the same as the deadline for filing the RL-1 summary.

| Situation | Filing deadline |

|---|---|

| You temporarily stop making periodic remittances of source deductions and employer contributions but continue operating your business. | Last day of February of the year following the year covered by the RL-1 summary |

| You permanently stop making periodic remittances of source deductions and employer contributions because you no longer have employees. | 20th day of the month following the month in which you made your last remittance |

| You stopped operating your business. | 30th day after the date on which your business activities stopped |

| The person required to file the RL-1 summary has died. | 90th day following the date of death (the RL-1 summary must be filed by the person's legal representative) |

References: 1086R65, 1086R67, 1086R68, 1086R70, 1086R71; ALS 39.0.3; AWSDR 15; ARAMQ 34.0.0.0.1; API (r.3) 7.2; AQPP (r.2) 11.2

4.3. Filing the RL-1 summary

If your business is registered for My Account for businesses, you can use the services to complete and file the RL-1 summary online. If you do not file the RL-1 summary online, you must send it to us on paper (even if you filed your RL-1, RL-2, RL-25 and RL-32 slips online, in an XML file).

Specialized service providers can file your RL-1 summary using the online services in My Account for professional representatives.

Copy 1 of any paper RL-1, RL-2, RL-25 and RL-32 slips must be enclosed with the RL-1 summary, unless the slips or the summary is filed online.

Documents that are not filed online must be mailed to us at one of the following addresses:

| Montréal, Laval, Laurentides, Lanaudière and Montérégie | Revenu Québec C. P. 6700, succursale Place-Desjardins Montréal (Québec) H5B 1J4 |

|---|---|

| Québec City and other regions | Revenu Québec C. P. 25666, succursale Terminus Québec (Québec) G1A 1B6 |

Additional information on filing the RL-1 summary can be found in guide ED-425-V, Tax Preparers' Guide: RL Slips.

4.4. Penalties

Under the Tax Administration Act, you are liable to a penalty if you file the RL-1 summary late.

References: TAA 59, 59.0.2

5. How to complete the RL-1 summary

5.1. Identification

Enter your name, address and identification number as shown on the remittance form (TPZ-1015.R.14.1-V, TPZ-1015.R.14.2-V, TPZ-1015.R.14.3-V or TPZ-1015.R.14.4-V) that you use to make periodic remittances of source deductions and employer contributions.

5.2. Filing RL-1, RL-2, RL-25 and RL-32 slips

Line 1 – Number of RL slips filed on paper

Enter the number of RL-1, RL-2, RL-25 and RL-32 slips you are filing by mail on paper.

Line 2 – Number of RL slips filed online

Enter the number of RL-1, RL-2, RL-25 and RL-32 slips you are filing online (including those you are filing using the services in My Account for businesses). Also include the number of RL-1 slips that a specialized service provider filed for you using the online services in My Account for professional representatives.

Line 3 – Transmitter number (if applicable)

Enter the transmitter number if the RL-1, RL-2, RL-25 and RL-32 slips were filed online (in an XML file). The transmitter number is made up of the letters “NP” followed by 6 digits.

5.3. Statement of duties paid or payable

Lines 5 to 16

Enter the total of all Québec Pension Plan (QPP) contributions (column B), Québec parental insurance plan (QPIP) premiums (column C), source deductions of Québec income tax (column D) and health services fund contributions (column E) that you must report for each remittance period of the year, according to your remittance frequency. However, if your remittance frequency is twice monthly or weekly, enter the total QPP contributions, QPIP premiums, source deductions of Québec income tax and health services fund contributions you must report for each month.

The amount you have to enter for a remittance period is generally the amount you entered in boxes A to D of the Remittance of Source Deductions and Employer Contributions (form TPZ-1015.R.14.1-V, TPZ-1015.R.14.2-V, TPZ-1015.R.14.3-V or TPZ-1015.R.14.4-V, according to your remittance frequency).

Check any pre-printed amounts that are shown on lines 5 to 16. If the amounts do not match the duties paid or assessed, make the necessary corrections and send us the supporting documents.

If no amount is entered for a given remittance period (for example, for the month of December), enter the source deductions of Québec income tax, QPP contributions, QPIP premiums and contribution to the health services fund that you have to report for that period in the appropriate columns, even if you have not yet paid the amounts.

5.4. Source deductions of Québec income tax, QPP contributions and QPIP premiums

5.4.1. Québec Pension Plan (QPP) contributions

Line 21 – Employee contributions

Enter the total of box B.A from all the RL-1 slips you filed. The QPP contribution must include the base contribution and the first additional contribution.

Line 22 – Employer contribution

Enter the amount from line 21 because you have to contribute an amount equal to the QPP contributions you withheld from your employees' pensionable salaries and wages. Your employer QPP contribution must include the base contribution and the first additional contribution.

Line 23 – Additional employee contributions

Enter the total of box B.B from all the RL-1 slips you filed. These amounts correspond to the second additional QPP contribution that employees made.

Line 24 – Additional employer contribution

Enter the amount from line 23 because your additional employer contribution corresponds to the second additional QPP contribution you withheld from the portion of the employee's pensionable salary or wages that exceeds the maximum pensionable earnings under the QPP.

5.4.2. Québec parental insurance plan (QPIP) premiums

Line 28 – Employee premiums

Enter the total of box H from all the RL-1 slips you filed.

Line 29 – Employer premium

Multiply the total of box I from all the RL-1 slips you filed by the employer's premium rate for the year (0.692%) and enter the result.

5.4.3. Québec income tax

Line 35 – Québec income tax withheld (RL-1 and RL-25 slips)

Enter the combined total of box E from all the RL-1 slips you filed and of box I from all the RL-25 slips you filed.

Line 36 – Québec income tax withheld (RL-2 and RL-32 slips)

Enter the combined total of box J from all the RL-2 slips you filed and of box D from all RL-32 slips you filed.

5.4.4. Source deductions and employer contributions paid or payable in the year

Line 44

Enter the amount from column B of line 17. This amount is the total QPP contributions you reported for the year. See Statement of duties paid or payable.

Line 45

Enter the amount from column C of line 17. This amount is the total QPIP premiums you reported for the year. See Statement of duties paid or payable.

Line 46

Enter the amount from column D of line 17. This amount is the total source deductions of Québec income tax you reported for the year. See Statement of duties paid or payable.

Line 48 – Source deductions of Québec income tax, QPP contributions and QPIP premiums (balance due or refund)

Subtract line 47 from line 38. Enter the result.

A negative amount means that your periodic remittances were too high.

To receive a refund of any overpaid amount, complete line 49.

Overpayments

You can only request a refund of overpaid source deductions of income tax, employee QPP contributions and QPIP premiums if an employee has repaid you an amount equal to net income you paid by mistake. For more information, see the Guide to Filing the RL-1 Slip (RL-1.G-V).

An employee can request a refund of an overpaid contribution when filing an income tax return.

5.5. Contribution to the health services fund

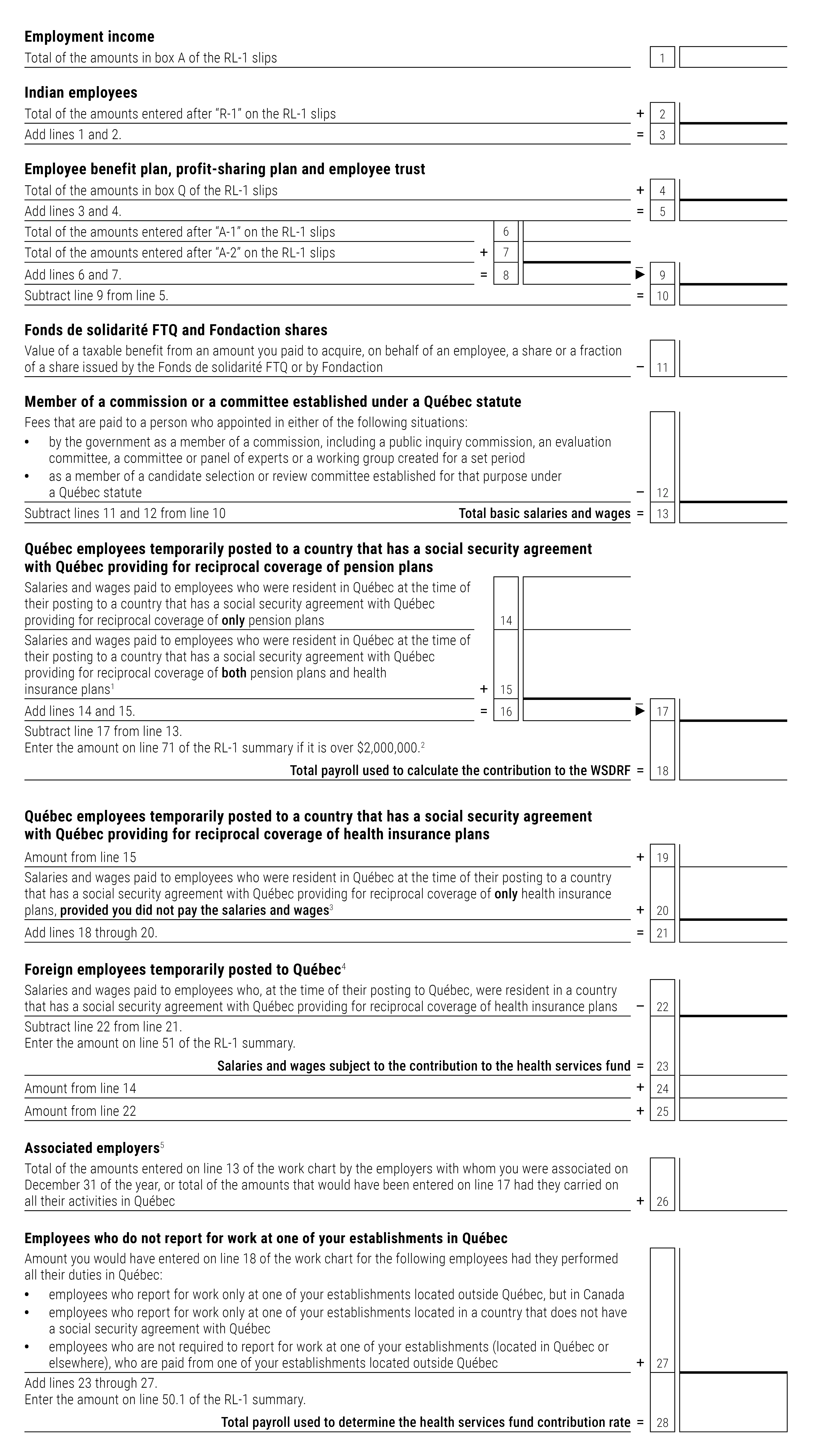

Line 50.1 – Total payroll used to determine the contribution rate that applies in your situation

Enter the total of box A from all the RL-1 slips you filed. Do not enter the total if one of the following situations applies to you:

- You are associated with other employers on December 31 of the year (see the instructions for line 50.2).

- You paid a salary or wages to an employee who is an Indian.

- One of your employees does not report for work at one of your establishments located in Québec (including a Québec employee temporarily posted outside Canada).

- One of your employees is not required to report for work at one of your establishments (located in Québec or elsewhere) but is paid from one of your establishments located outside Québec.

- You paid a salary or wages to a foreign employee who is temporarily posted to Québec.

- You paid or allocated an amount under an employee benefit plan, a profit-sharing plan or an employee trust.

- You paid an amount to acquire, on behalf of an employee, a share or a fraction of a share issued by the Fonds de solidarité of the Fédération des travailleurs et travailleuses du Québec (FTQ) or by Fondaction.

- You paid fees to a member of a commission or a committee established under a Québec statute.

If one of the above situations applies to you, complete the work chart in Appendix 1 to calculate the total payroll you have to enter on line 50.1.

The amount on line 50.1 is used only to determine your health services fund contribution rate.

References: ARAMQ 33 (“total payroll”), 33.0.2 to 33.0.4

Line 50.2 – Employer associated with other employers on December 31 of the year

Check this box if you were associated with other employers on December 31 of the year (regardless of where they carried on their activities and whether they are subject to the Taxation Act).

If you check this box, complete the work chart in Appendix 1 to determine the total payroll amount to enter on line 50.1.

Subject to certain adaptations, the rules set forth in the Taxation Act respecting associated corporations must be applied to determine whether two or more corporations are considered to be associated employers on December 31 of the year. For more information on associated corporations, see the Guide de la déclaration de revenus des sociétés (CO-17.G) (available in French only).

Line 50.3 – NAICS code

If your total payroll (amount on line 50.1) is less than $7.8 million and more than 50% of that payroll is attributable to activities in the primary and manufacturing sectors, enter the NAICS code below for your sector of activity.

Enter:

- code 11, if more than 50% of your total payroll is attributable to activities in the agriculture, forestry, fishing and hunting sector

- code 21, if more than 50% of your total payroll is attributable to activities in the mining, quarrying and oil and gas extraction sector

- code 31, 32 or 33, if more than 50% of your total payroll is attributable to activities in the manufacturing sector

Descriptions of the codes are available on the Statistics Canada website.

Reference: ARAMQ 33 (“eligible specified employer”)

Total payroll attributable to activities in the primary and manufacturing sectors

When calculating the total payroll attributable to activities in the primary and manufacturing sectors, take into account the salaries and wages of employees whose functions are related to those activities.

An administrative assistant works for a small business in the manufacturing sector. The assistant's salary must be included in the total payroll attributable to activities in the primary and manufacturing sectors because the assistant's functions are related to those activities.

A medium-sized business in the manufacturing sector has a division that delivers finished products. The wages the division pays an employee who delivers the products must not be included in the total payroll attributable to activities in the primary and manufacturing sectors, because the employee's functions are not related to such activities.

Line 51 – Salary and wages subject to the contribution

Enter the total of box A from all the RL-1 slips you filed. Do not enter the total if one of the following situations applies to you:

- You paid a salary or wages to an employee who is an Indian.

- One of your Québec employees is temporarily posted outside Canada.

- You paid a salary or wages to a foreign employee who is temporarily posted to Québec.

- You paid or allocated an amount under an employee benefit plan, a profit-sharing plan or an employee trust.

- You paid an amount to acquire, on behalf of an employee, a share or a fraction of a share issued by the Fonds de solidarité of the Fédération des travailleurs et travailleuses du Québec (FTQ) or by Fondaction.

- You paid fees to a member of a commission or a committee established under a Québec statute.

If one of the above situations applies to you, complete the work chart in Appendix 1 to calculate the salary and wages subject to the contribution to the health services fund that you have to enter on line 51.

References: ARAMQ 33, 33.2, 34, 34.0.0.1 to 34.0.0.3, 34.0.2; RAMQ. 34-2/R2

Line 52 – Salary and wages eligible for the credit for contributions to the health services fund

If you hold an annual certificate issued by the Minister of Finance for a given year confirming that a project qualifies as a large investment project and certifying that the project is being carried out in that year, you may be eligible for a credit for contributions to the health services fund in respect of eligible activities relating to the large investment project.

To claim the credit:

- Enter “06” in box 52.1.

- On line 52, enter the portion of the amount on line 51 that relates to eligible activities under the large investment project and that is included in the exemption period. Do not include the portion paid to an employee whose duties consist in building, expanding or modernizing the site where a large investment project will be carried out.

Do not include the following on line 52:

- directors' fees paid to a director

- bonuses and incentives

- taxable benefits

- commissions

The tax assistance that a corporation, a partnership or a corporation that is a member of a partnership may receive in respect of a large investment project for a given year cannot exceed an amount corresponding to its tax assistance limit. For more information, see the Guide de la déclaration de revenus des sociétés (CO-17.G) (available in French only).

References: 771.1, 771.12; ARAMQ 33 (“exempt employer,” “eligibility period,” “exemption period,” “qualified corporation”), 34, 34.0.0.0.3, 34.1.0.1

Documents to enclose

If you entered an amount on line 52, you have to enclose the following documents with the summary when you file it:

- a copy of the annual certificate issued by the Minister of Finance for the year concerned

- a copy of the independent auditor's report, if you are an employer that is a partnership carrying out a large investment project and you enclose with the RL-1 slip a copy of the first annual certificate issued by the Minister of Finance

- a copy of the sharing agreement for the year concerned, if you are a member of a partnership that is carrying out a large investment project and the partnership elected to allocate a portion or all of its tax assistance limit to its members

Line 54 – Contribution rate

The table below shows the rate you have to enter on line 54 to calculate your contribution to the health services fund.

| Total payroll (line 50.1) | Rate for all employers, except primary and manufacturing sector employers and public sector employers | Rate for primary and manufacturing sector employers | Rate for public sector employers |

|---|---|---|---|

| $1,000,000 or less | 1.65 | 1.25 | 4.26 |

| $1,000,001 to $7,799,999 | 1.2662 + (0.3838 × total payroll ÷ $1,000,000) | 0.8074 + (0.4426 × total payroll ÷ $1,000,000) | 4.26 |

| $7,800,000 or more | 4.26 | 4.26 | 4.26 |

A primary and manufacturing sector employer is an employer whose total payroll is more than 50% attributable to activities in the primary and manufacturing sectors. These activities are grouped under codes 11, 21 and 31 to 33 of the North American Industry Classification System (NAICS). See the Statistics Canada website for a description of NAICS codes.

“Public sector employer” means:

- the government of Canada or of a province

- a municipality

- a mandatary body of the State, of the Government of Canada, of a province or of a municipality

- a municipal or public body (for example, a school board) that performs a function of government in Canada and that is exempt from income tax at a given time in the calendar year

- a corporation, commission or association that is exempt from income tax at a given time in the calendar year pursuant to section 985 of the Taxation Act (in particular, a corporation at least 90% owned by the State)

References: ARAMQ 33 (“specified employer”), 34

Line 56

Enter the amount from column E of line 17. This amount is the total health services fund contributions you must report for the year. See Statement of duties paid or payable.

5.6. Contribution related to labour standards

Line 61 – Remuneration subject to the contribution

If you are an employer that is subject to the contribution related to labour standards, complete form LE-39.0.2-V, Calculation of the Contribution Related to Labour Standards, for the year concerned. Enter the amount from line 34 of form LE-39.0.2-V on line 61 of the RL-1 summary.

All employers must make labour standards contributions, except:

- religious institutions

- fabriques

- corporations of trustees for the erection of churches

- institutions or charities whose object is to assist, directly and free of charge, persons in need

- businesses whose labour relations are governed by the Canada Labour Code (such as banks, airports and radio stations)

- international government bodies with head offices in Québec

You are not required to enclose form LE-39.0.2-V with the summary when you file it. However, you must keep it in case we ask for it.

References: ALS 1, 39.0.1 (“remuneration,” “remuneration subject to contribution“), 39.0.2; ALS (r. 5) 1

Line 63 – Contribution related to labour standards

Multiply the amount on line 61 by the contribution rate (0.06%) and enter the result.

The amount on line 63 of the RL-1 summary and the amount on line 36 of form LE-39.0.2-V must be the same.

Line 64

Enter the amount of the payment of the contribution related to labour standards, provided you have not already made it.

Note that the payment of the contribution related to labour standards for the year must be received by Revenu Québec or a financial institution by the deadline for filing the RL-1 summary (see Filing deadline). You must complete the remittance slip included with the RL-1 summary.

5.7. Contribution to the WSDRF

Line 71 – Total payroll

Enter your total payroll only if it exceeds $2 million. If you have more than one establishment or if you hold a training initiative quality certificate, see You have more than one establishment and You hold a training initiative quality certificate.

Your total payroll corresponds to the total of box A from all the RL-1 slips you filed. Do not enter the total if one of the following situations applies to you:

- You paid a salary or wages to an employee who is an Indian.

- One of your Québec employees is temporarily posted outside Canada.

- You paid or allocated an amount under an employee benefit plan, a profit-sharing plan or an employee trust.

- You paid an amount to acquire, on behalf of an employee, a share or a fraction of a share issued by the Fonds de solidarité of the Fédération des travailleurs et travaileuses du Québec (FTQ) or by Fondaction.

- You paid fees to a member of a commission or a committee established under a Québec statute.

If one of the above situations applies to you, complete the work chart in Appendix 1 to calculate your total payroll.

References: AWSDR 4 and Schedule; AWSDR (r. 4) 1

Line 73

Multiply the amount on line 71 by 1% and enter the result.

Reference: AWSDR 3

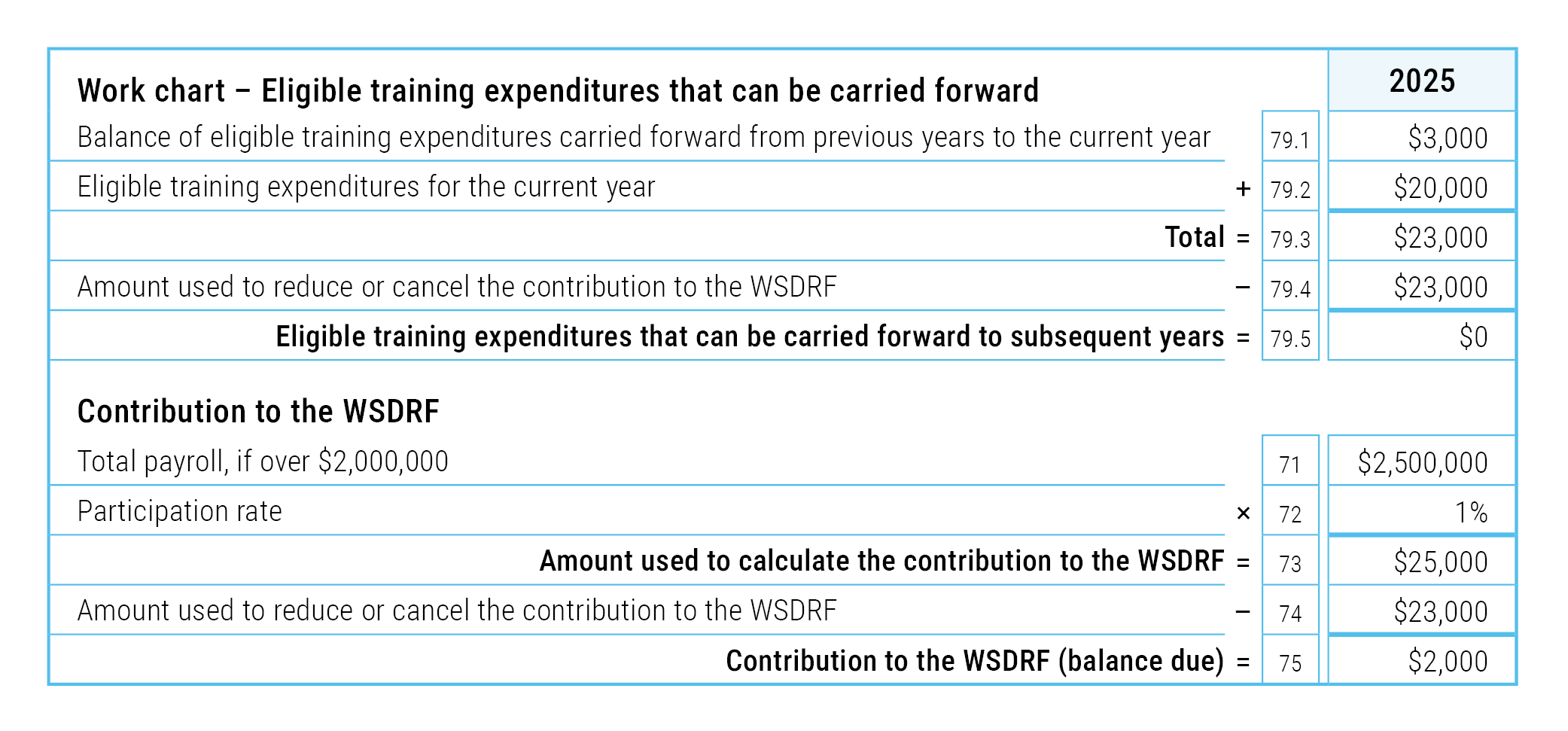

Line 74 – Eligible training expenditures

Complete the work chart and enter the amount from line 79.4 of the work chart on line 74 of the summary.

References: AWSDR 5 to 9; AWSDR (r. 3) 1, 4; AWSDR (r. 7) 1

Balance of eligible training expenditures carried forward from previous years to the current year (line 79.1 of the work chart)

If applicable, enter the amount from line 79.5 of the work chart on the RL-1 summary you completed for the previous year.

If your total payroll on line 71 exceeds $2 million for the year and it did not for the previous year, you can enter the eligible training expenditures incurred in the previous year on line 79.1 of the work chart.

Reference: AWSDR 11

Over the last three years, your employees took part in training courses offered by a vocational training centre.

- For 2023, your training expenditures were $1,500 and your total payroll was $600,000.

- For 2024, your training expenditures were $3,000 and your total payroll was $900,000.

- For 2025, your training expenditures were $20,000 and your total payroll was $2,500,000.

For 2023 and 2024, you were not required to contribute to the WSDRF, since your total payroll was less than $2 million.

For 2025, your contribution to the WSDRF is $2,000 (see the table below). You can only carry the training expenditures of $3,000 from 2024 forward to 2025, because your total payroll for 2025 is more than $2 million.

Eligible training expenditures for the current year (line 79.2 of the work chart)

Enter the result of the following calculation:

- the total of all eligible training expenditures incurred in the year (for training intended to improve the qualifications and skills of employees)

minus

- any government assistance – subsidy, grant, forgivable loan, tax credit, investment allowance or other – that you received in respect of the expenditures (do not subtract government assistance received in respect of eligible training expenditures incurred in the year if you are a childcare centre (CPE), a subsidized day care centre, a home educational childcare coordinating office, a job integration company, an ambulance service, the Corporation d'urgences-santé, or a non-profit organization or cooperative that is a certified adapted business)

The following are eligible training expenditures:

- the salaries and wages paid to employees for the hours they spend on training activities (whether they are attending a training activity or leading it)

- the salaries and wages paid to trainees from a recognized educational institution during their training session

- the salaries and wages paid to supervisors of interns and guides for teachers doing refresher training in the workplace, for the hours they devote exclusively to supervision and support activities

- any expenses related to training activities (for example, travel expenses, cost of the training, payments you make to or expenditures you incur with a recognized training mutual)

For more information on calculating eligible training expenditures, see the Guide sur les dépenses de formation admissibles (available in French only) on the website of the Commission des partenaires du marché du travail, or contact us.

References: AWSDR (r. 3) 1 to 7

Amount used to reduce or cancel the contribution to the WSDRF (line 79.4 of the work chart)

Enter the lesser of:

- the amount on line 73 of the summary

- the amount on line 79.3 of the work chart

Eligible training expenditures that can be carried forward to subsequent years (line 79.5 of the work chart)

Subtract the amount on line 79.4 from the amount on line 79.3 and enter the result.

Line 75

If you entered an amount on line 71, subtract the amount on line 74 from the amount on line 73. If the result is $0, you do not have to contribute to the WSDRF for the year. Enter “0” on line 75.

If you did not enter an amount on line 71, you do not have to contribute to the WSDRF for the year. Enter “0” on line 75.

5.7.1. You have more than one establishment

If you have more than one establishment, enter the combined total payroll of all your establishments on line 71 if it is more than $2 million.

You have to file an RL-1 summary for each establishment that has an employer account. However, since the contribution to the WSDRF must be calculated for the business as a whole (and not for individual establishments), include all data pertaining to the contribution on lines 71 through 75 of only one of the RL-1 summaries you are filing.

A corporation has two establishments. One establishment has a total payroll of $1,600,000 and the other of $700,000, for a combined total payroll of $2,300,000. Since the total payroll is over $2,000,000, the corporation is subject to the Act to promote workforce skills development and recognition. The corporation must enter $2,300,000 on line 71 and complete lines 72 through 75 on the RL-1 summary it is filing for one of its establishments and leave lines 71 through 75 blank on the RL-1 summary it is filing for the other establishment.

5.7.2. You hold a training initiative quality certificate

If you hold a training initiative quality certificate issued by the Commission des partenaires du marché du travail, leave lines 71 through 75 blank. You do not have to contribute to the WSDRF for the year.

Reference: AWSDR (r. 5) 1

5.8. Refund or balance due

Line 81 – Refund

Enter the amount from line 80, if it is negative. This is the amount you overpaid.

If you want this amount refunded, complete line 83.

Line 82 – Balance due

Enter the amount from line 80, if it is positive. This is the amount you have to pay. You are not required to pay a balance of less than $2.

Remember to complete the remittance slip.

See Making your payment for information on paying a balance due and filing the RL-1 summary remittance slip.

5.9. Certification

The RL-1 summary must be signed by the person who provided the requested information.

6. Making your payment

6.1. How to complete the remittance slip

If you have a balance due on line 82, complete the RL-1 summary remittance slip.

Periodic CNESST payments

Do not add information regarding the periodic payments for the Commission des normes, de l'équité, de la santé et de la sécurité du travail (CNESST) that you make to Revenu Québec to the remittance slip of the RL-1 summary. Do not include any amounts relating to the payment of the occupational health and safety insurance premium with the remittance slip.

To report and remit amounts for the CNESST, use the remittance slip attached to the Remittance of Source Deductions and Employer Contributions (form TPZ-1015.R.14.1-V, TPZ-1015.R.14.2-V, TPZ-1015.R.14.3-V or TPZ-1015.R.14.4-V, according to your remittance frequency) that we have sent you.

6.2. Payment options

You can make your payment online, at a financial institution (counter or ATM) or by mailing a cheque or money order payable to the Minister of Revenue of Québec. You must make payments of more than $10,000 electronically (online or through a financial institution), unless special circumstances prevent you from doing so. If you do not, a penalty may be applied.

6.2.1. Online payment

You can make a payment using a participating financial institution's online payment service. You will need the payment code shown on the RL-1 summary remittance slip.

If you send us the RL-1 summary using the online services in My Account for businesses, you can use the preauthorized debit option, provided you have already sent us form LM-2.DP-V, Payer's Pre-authorized Debit Agreement: Business PAD.

If you make your payment online, you do not have to send us the RL-1 summary remittance slip.

References: TAA 12.0.1 and 27.1

6.2.2. By mail

You can make your payment by mailing a cheque or money order made payable to the Minister of Revenue of Québec. Send your payment with the completed RL-1 summary remittance slip to one of the addresses under Filing the RL-1 summary.

6.2.3. Payment at a financial institution (ATM or counter)

You can make your payment at a financial institution (ATM or counter) using the RL-1 summary remittance slip we sent you. The effective date of payment is the day on which the financial institution processes the transaction. Check with your financial institution to find out if these payment options are available.

6.3. Payment deadline

Your payment must be received by Revenu Québec or processed by a financial institution no later than the filing deadline for the RL-1 summary (see Filing deadline).

References: TAA 27.1; AWSDR 15, 19; ALS 39.0.3, 39.0.6

6.4. Interest on insufficient periodic payments

The Québec income tax, Québec Pension Plan (QPP) contributions and Québec parental insurance plan (QPIP) premiums you withhold from the remuneration you pay and your employer QPP contributions, QPIP premiums and contributions to the health services fund must be remitted to us periodically using the Remittance of Source Deductions and Employer Contributions (form TPZ-1015.R.14.1-V, TPZ-1015.R.14.2-V, TPZ-1015.R.14.3-V or TPZ-1015.R.14.4-V, according to your remittance frequency). If your periodic payments are less than what is required, the balance is subject to interest charges from the due date of each payment.

This means that a positive amount (balance due) entered on line 48 or line 57 of the RL-1 summary is subject to interest charges from the due date of each payment.

Note, however, that if a portion of a balance due on line 57 results from the difference between the actual health services fund contribution rate (line 54) and the estimated health services fund contribution rate (the rate you would have entered on line 54 had your total payroll been the same as that of the previous year), that portion is subject to interest charges from the filing deadline for the RL-1 summary. The remaining portion of the balance due is subject to interest charges from the due date of each payment.

For more information regarding the periodic payment of source deductions and employer contributions, see the Guide for Employers (TP-1015.G-V).

References: TAA 28; TAA (r. 1); 28R1, 28R2, 28R3

6.5. Penalties

Under the Tax Administration Act, you are liable to a penalty if you:

- file a remittance slip late

- are late in paying an amount you should have paid before filing the RL-1 summary

If you fail to pay or remit an amount you withheld or collected under a tax law by the prescribed deadline, the rate of the penalty will be determined based on the number of days the payment or remittance is late. From the 1st to the 7th day, the rate is 7% of the amount owing; from the 8th to the 14th day, it is 11% of the amount owing; and, as of the 15th day, it is 15% of the amount owing.

References: TAA 59, 59.2

7. Special cases

7.1. Employer that succeeds another employer

If an employer succeeds another employer following the formation or winding-up of a corporation or following the acquisition of the major portion of the property of a business or of a separate part of a business, and there was no interruption in an employee's service, the successor employer and the previous employer must each file an RL-1 summary for the period that concerns them.

Special rules may apply if an employer succeeds another employer following the amalgamation or winding-up of a subsidiary. See Employer that amalgamates with another corporation and Employer that winds up a subsidiary for information on filing the RL-1 summary in those situations.

7.1.1. Previous employer

See Table 1 under Filing deadline for a previous employer's deadline for filing the RL-1 summary when:

- the previous employer stopped making periodic remittances of source deductions and employer contributions

- the person required to file the RL-1 summary has died

Payment of any amount shown on line 82 of the summary must also be received by Revenu Québec or by a financial institution by that date.

See Employer that stops operating its business if the employer stopped operating its business.

7.1.2. Successor employer

The successor employer must file the RL-1 summary for the year by the last day of February of the following year. Payment of any amount shown on line 82 of the summary must also be received by Revenu Québec or by a financial institution by that date.

7.2. Employer that amalgamates with another corporation

If an employer that is a corporation amalgamates with one or more other corporations, the amalgamated corporations are not required to file the RL-1 summary for the period preceding the amalgamation. However, the corporation resulting from the amalgamation must file the RL-1 summary for the entire year. It must file the RL-1 summary for the year by the last day of February of the following year. Payment of any amount shown on line 82 of the summary must also be received by Revenu Québec or by a financial institution by that date.

7.3. Employer that winds up a subsidiary

If an employer that is a parent corporation winds up a subsidiary and at least 90% of the subsidiary's property is attributed to the employer, the wound-up subsidiary is not required to file an RL-1 summary for the period preceding the winding-up. The parent corporation must include the information for the wound-up subsidiary for the entire year in the RL-1 summary it files. It must file its RL-1 summary for the year by the last day of February of the following year. Payment of any amount shown on line 82 of the summary must also be received by Revenu Québec or by a financial institution by that date.

7.4. Employer that stops operating its business

An employer that stops operating its business must file its RL-1 summary for the year within 30 days after the date on which the business activities stopped. Payment of any amount shown on line 82 of the summary must also be received by Revenu Québec or by a financial institution within that time.

Special rules may apply if an employer stops operating its business following the amalgamation or winding-up of a subsidiary. See Employer that amalgamates with another corporation and Employer that winds up a subsidiary for information on filing the RL-1 summary in those situations.

Employer associated with other employers

An employer that was associated with other employers must calculate its total payroll on line 50.1 taking into account only the salaries and wages it paid in the year from January 1 to the date the business stopped operating. Salaries and wages paid by employers with whom the employer was associated on that date must not be included.

The employer must file an amended RL-1 summary for the year by the last day of February of the year following the year covered by the summary in the following situations:

- The employer was operating another business on December 31 of the year concerned.

- The health services fund contribution rate on line 54 of the RL-1 summary the employer filed is different from the rate determined based on the employer's total payroll for the year (taking into account the combined total of the salaries and wages paid in the year by the employer and by any employers with whom the employer was associated on December 31 of the year concerned).

Only lines 50.1 through 57 and line 80 should be completed on the amended RL-1 summary; box 95 should be completed on the remittance slip.

7.5. Employer in the restaurant, bar or hotel sector

An employer in the restaurant, bar or hotel sector must complete form TP-1086.R.1-V, Employer's Statement of Tips and Tippable Sales, to report its employees' tips and tippable sales for a given year.

For more information about tips, see IN-250-V, Tax Measures Respecting Tips.

Document to enclose

The employer must enclose a completed copy of form TP-1086.R.1-V for each of its establishments with the RL-1 summary it files.

8. Appendix 1

8.1. Work chart – Lines 50.1, 51 and 71 of the RL-1 summary

This work chart cannot be read by a screen reader because it cannot currently be adapted to meet accessibility standards.

1. Québec currently has a social security agreement providing for reciprocal coverage of both pension plans and health insurance plans with Belgium, Denmark, Finland, France, Greece, Luxembourg, Norway, Portugal, Romania, Serbia and Sweden.

2. If you have to file more than one RL-1 summary because you have more than one establishment, do not enter the amount from line 18 of the work chart completed for each establishment on line 71 of each RL-1 summary. Instead, enter the total of line 18 from all work charts completed on the RL-1 summary completed for one of your establishments, if the total is more than $2,000,000. For more information, see You have more than one establishment.

3. Your employees must inform you in writing, by March 1 of the year following the year in which they were posted outside Canada, of the salary or wages that they were paid while they were outside Canada.

4. Québec currently has a social security agreement providing for reciprocal coverage of health insurance plans with Belgium, Denmark, Finland, France, Greece, Luxembourg, Norway, Portugal, Romania, Serbia and Sweden.

5. To determine if you were associated with other employers on December 31 of the year (regardless of where the associated employers carried on their activities and of whether they are subject to the Taxation Act), see the instructions for line 50.2 under Contribution to the health services fund.